Charity Donations Scheme

Tax return on giving to Irish Mission Agencies Partnership as a registered charity

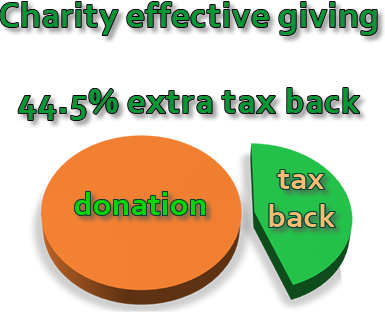

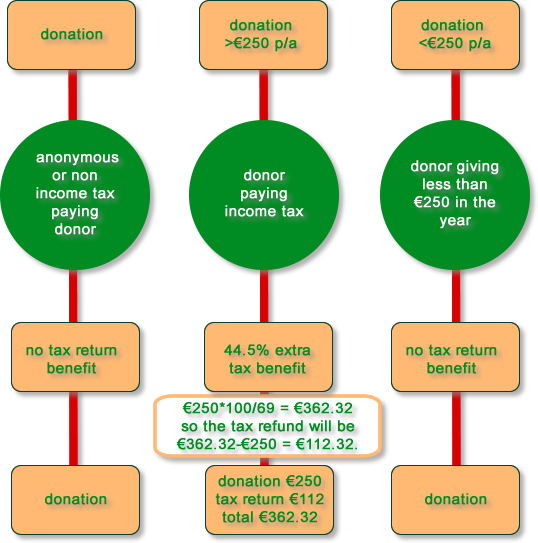

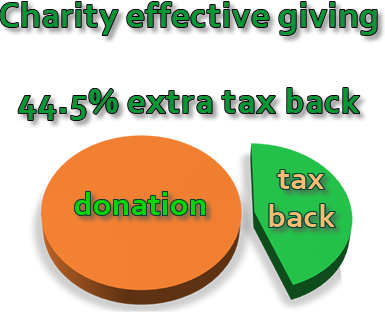

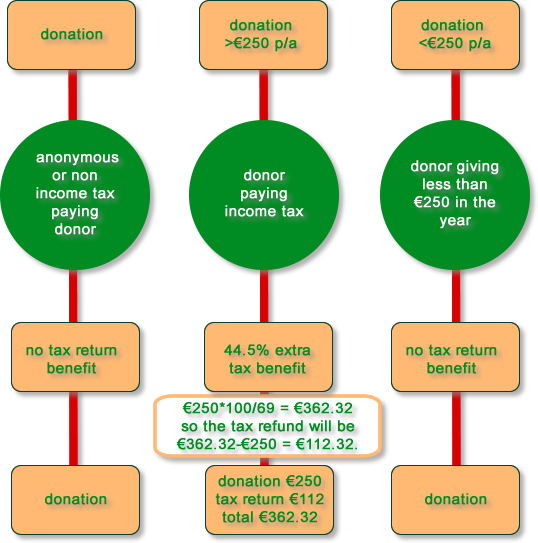

The Charity Donations Scheme on qualifying donations to eligible charities from Rep of Ireland income tax paying donors goes to the charity at a rate of 44.5% extra. A 5% iMAP charge applies on income up to €5,000 cut-off point in on transaction, with no additional charge on the larger amount.

Example:

A donation of €250 will be grossed up at 31% as follows:

€250*100/69 = €362.32 so the tax refund will be €362.32-€250 = €112.32.

On this basis the tax refund on a donation of €500 will be €224.64 and on €1,000 it will be €449.27.

Contact Irish Mission Agencies Partnership

Email us at:

It is important to notify us by email when donating so we have details of what your donation is for and that we can contact you.

Donate to Irish Misssion Agencies Partnership

Note: .

In all cases be sure to notify iMAP who your donations are for and your contact info.

New donors can make a declaration to iMAP HERE.

Qualifying donation criteria:

- Threshold is €250 in the year.

- The donation is given with no benefit to the donor.

- The donor is an income tax payer regardless of rate.

- Annual limit of €1million per individual can be relieved. No higher earner restriction.

- ‘Associated’ donor is limited to 10% of annual income.

- Signed CHY3 or CHY4 form valid for one or five years with PPS details.

44.5% extra on a €250 donation yields €112.32 tax return.

Irish

Irish